- Розуміння ізраїльського спадкового права

- Короткий огляд ізраїльського спадкового права

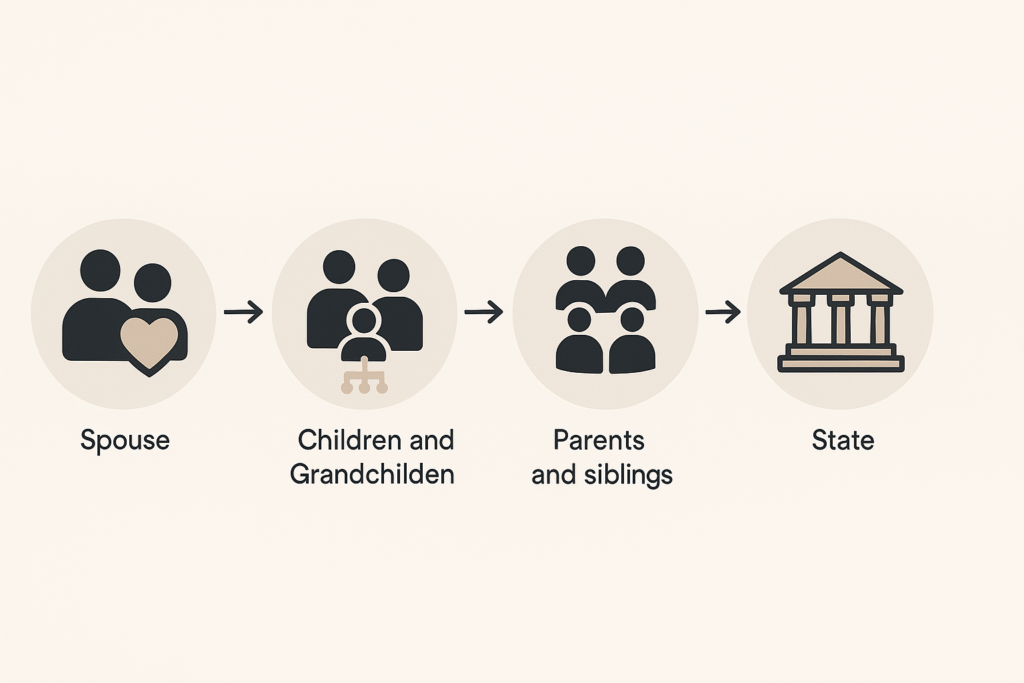

- Ієрархія спадкоємців в Ізраїлі

- Примітка:

- Що відбувається, якщо немає волі?

- Примітка:

- Примітка:

- Заповіти в Ізраїлі: Спадкування за заповітом

- Примітка:

- Примітка:

- Примітка:

- Подружжя та діти: Їхні права за ізраїльським спадковим правом

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Ізраїльський закон про спадщину: Правова процедура управління спадщиною

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- 4 ключові поради для спадкоємців за кордоном

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Типові проблеми, з якими стикаються спадкоємці у справах про спадщину в Ізраїлі

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Останні думки: Як орієнтуватися в ізраїльському спадковому праві

- Детально розібратися в ізраїльському процесі оформлення заповіту

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Основні проблеми в ізраїльському процесі оформлення спадщини для спадкоємців за кордоном

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Спадкове право Ізраїлю: Права подружжя та дітей

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Важливість складання дійсного заповіту в Ізраїлі

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Роль ізраїльського юриста в управлінні спадщиною

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Робота з нерухомістю в процесі спадкування

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Поширені запитання про спадкове право в Ізраїлі

- 1. Чи може іноземний спадкоємець успадкувати майно в Ізраїлі?

- 2. Чи потрібно мені перебувати в Ізраїлі, щоб управляти спадщиною?

- 3. Які податки пов'язані зі спадщиною в Ізраїлі?

- 4. Скільки часу триває процес оформлення спадщини?

- 5. Що відбувається, якщо немає волі?

- 6. Як відбувається процес отримання розпорядження про заповіт в Ізраїлі?

- 7. Чи можна використовувати іноземний заповіт в Ізраїлі?

- 8. Скільки часу триває процес оформлення спадщини?

- 9. Чи існує в Ізраїлі податок на спадщину?

- 10. Що робити, якщо спадкоємець відмовляється брати участь у спадковому процесі?

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

- Примітка:

Розуміння ізраїльського спадкового права

Коли близька людина помирає, розібратися з юридичними процедурами, пов'язаними з її спадщиною, може виявитися непростим завданням, особливо якщо вона знаходиться в Ізраїлі, а спадкоємці проживають за кордоном. Спадкове право Ізраїлю, хоча і побудоване на принципах справедливості та рівності, все ж може створювати проблеми для спадкоємців, які не знайомі зі специфікою ізраїльського законодавства або проживають за межами країни.

Цей посібник пояснює основи спадкового права в Ізраїлі, зосереджуючись на правилах розподілу майна та активів між спадкоємцями, а також на пов'язаних з цим процедурах. Крім того, ми надамо чотири важливі поради для спадкоємців, особливо тих, хто живе за кордоном Ізраїль, про те, як ефективно керувати цим процесом.

Короткий огляд ізраїльського спадкового права

Спадкове право в Ізраїлі в першу чергу регулюється Ізраїльський закон про правонаступництво 1965 року. Цей закон визначає, як розподіляються активи після смерті людини, незалежно від того, чи залишила вона заповіт, чи ні. Спадкове право Ізраїлю покликане забезпечити справедливий розподіл майна між спадкоємцями, з акцентом на рівність між членами сім'ї.

Принцип рівності

Одним з основоположних принципів ізраїльського спадкового права є рівність. Це означає, що, загалом кажучи, кожен із спадкоємців померлої особи має право на рівну частку майна. Закон передбачає ієрархію спадкування за замовчуванням, яка визначає, як буде розподілено майно, якщо немає заповіту.

Ієрархія спадкоємності в Ізраїлі починається з чоловік померлих, а потім їхні діти, а потім інші члени сім'ї, такі як батьки та брати і сестри, якщо немає дітей. Розуміння цієї ієрархії має вирішальне значення для будь-якого спадкоємця, оскільки вона визначає, хто і яку частину майна отримає.

Зміни з часом

Спадкове право Ізраїлю розвивалося з плином часу, вносячи зміни для адаптації до нових соціальних і сімейних структур. Незважаючи на ці зміни, основний принцип рівності залишився незмінним. Важливо також розуміти, що, незважаючи на те, що закон встановлює стандартні правила, люди мають свободу створювати заповіти для розподілу своїх активів у спосіб, який може відрізнятися від стандартних правил, встановлених Законом про спадкування.

Ієрархія спадкоємців в Ізраїлі

Хто успадковує за ізраїльським законодавством?

В рамках проекту Ізраїльський закон про спадщину, існує чітка ієрархія, яка диктує, хто має право успадковувати майно померлої людини:

- Чоловік/дружина: Першим у черзі на спадщину є чоловік або дружина померлого. Дружина/чоловік має право на значну частину майна, яка може включати особисті речі та половину інших активів, залежно від того, чи є діти або інші родичі.

- Діти та онуки: Наступними в черзі є діти померлого. Закон передбачає, що кожна дитина повинна отримати рівну частку майна. Якщо хтось із дітей помер, їхня частка розподіляється між їхніми нащадками (тобто онуками).

- Батьки та брати і сестри: Якщо у померлого не було дітей чи онуків, наступними успадковують батьки, а потім брати і сестри. Якщо батьки померли, спадщину отримують брати і сестри.

- Розширена сім'я: Якщо немає прямих спадкоємців, спадщина може перейти до більш далеких родичів, таких як бабусі та дідусі або їхніх нащадків (тітки, дядьки та двоюрідні брати і сестри померлого).

- Держава: Якщо спадкоємців не буде знайдено, майно з часом перейде до Держава Ізраїль.

Приклад спадкового розпорядження

Наприклад, якщо людина помирає, залишивши дружину/чоловіка, двох дітей і не залишивши заповіту, її майно буде розділене між дружиною/чоловіком і дітьми. Закон "Про спадщину чоловік отримають свою частку, включаючи особисті речі, такі як меблі, ювелірні вироби та інші речі, а також 50% з решти активів, тоді як діти розділить решту 50%.

Якщо померлий не мав подружжя, але залишив після себе дітей та онуків, то діти успадкують все майно порівну. Якщо дитина померла раніше за батьків, то частку померлої дитини успадковують її рідні діти (діти померлого онуки).

Що відбувається, якщо немає волі?

Коли хтось помирає без заповіту, кажуть, що його майно без заповіту. В Ізраїлі спадкування за заповітом регулюється правилами за замовчуванням, викладеними в Спадкове право. Ці правила визначають, хто успадковує яку частину майна, виходячи з ієрархії спадкоємців.

Право на спадкування за заповітом в Ізраїлі

- Права подружжя: Другий з подружжя, що пережив, має право успадкувати майно померлого рухоме майно, наприклад, автомобілі, меблі та особисті речі, на додаток до половини майна, що залишилося, якщо є діти.

- Права дитини: Діти мають право на рівну частку майна, що залишилося. Якщо дітей немає, чоловік або дружина можуть успадкувати більшу частину, а якщо немає родичів, що залишилися в живих, - все майно.

- Батьки та брати і сестри: Якщо немає подружжя або дітей, то померлий батьки і брати і сестри стають першочерговими спадкоємцями. Якщо батьків немає в живих, успадковують брати і сестри.

Що робити, якщо немає спадкоємців?

У рідкісних випадках, коли немає спадкоємців - ні чоловіка, ні дружини, ні дітей, ні онуків, ні батьків, ні братів і сестер - майно буде передано Держава Ізраїль. Держава може прийняти рішення про використання коштів або активів для суспільної користі.

Заповіти в Ізраїлі: Спадкування за заповітом

Типи заповітів, визнаних в Ізраїлі

A буде це юридичний документ, який дозволяє людині визначити, як будуть розподілені її активи після її смерті. В Ізраїлі існує чотири основні типи заповітів, які визнаються судами:

- Рукописний заповіт: Заповіт повинен бути повністю написаний власноруч заповідачем і підписаний ним.

- Свідок Вілл: Це найпоширеніший тип заповіту. Він повинен бути написаний і підписаний у присутності двох свідків, які також підписують документ.

- Усний заповіт: Цей тип заповіту складається усно в присутності двох свідків, як правило, коли заповідач вважає, що йому загрожує неминуча смерть.

- Воля перед владою: Це заповіт, складений перед офіційною особою, наприклад, суддею або реєстратором.

Важливість наявності заповіту в Ізраїлі

Наявність заповіту необхідна для тих, хто хоче, щоб їхнє майно було розділене інакше, ніж за замовчуванням, встановленим законом. Спадкове право. Заповіт дозволяє фізичним особам робити конкретні заповіти, призначати виконавця і навіть надавати інструкції щодо управління своїми активами.

Наприклад, хтось може захотіти залишити більшу частину свого майна дружині чи чоловікові, конкретній дитині або навіть благодійній організації. Без дійсного заповіту майно розподілятиметься згідно з правилами спадкування за замовчуванням, які можуть не збігатися з побажаннями померлого.

Подружжя та діти: Їхні права за ізраїльським спадковим правом

Спадкові права подружжя

Відповідно до ізраїльського законодавства про спадкування чоловік Дружина/чоловік померлого має певні права. Дружина/чоловік має право успадковувати особисті речі, включаючи предмети домашнього вжитку та транспортні засоби. Якщо у померлого залишилися діти, чоловік/дружина також успадковує половину майна, що залишилося, а інша половина ділиться між дітьми.

- Закон про майнові відносини (1973): Відповідно до цього закону, майно, накопичене під час шлюбу, зазвичай вважається спільне майно, а отже, той з подружжя, хто пережив, має право на нього. Це окремо від прав на спадщину, які поширюються на решту майна.

Примітка: Права того з подружжя, хто пережив, можуть бути порушені, якщо був шлюбний договір або іншу домовленість, яка змінює правила за замовчуванням.

Спадкові права дітей

Діти загиблого мають право на рівна частка майна. Це означає, що якщо є кілька дітей, кожна дитина успадкує рівну частину майна. Онуки можуть успадкувати частку своїх батьків, якщо батько пережив дідуся чи бабусю.

- Права на спадкування за заповітом: У разі відсутності заповіту діти автоматично успадковують майно померлого батька згідно з правилами спадкування за законом.

Ізраїльський закон про спадщину: Правова процедура управління спадщиною

Що таке спадщина?

Спадщина це юридичний процес, за допомогою якого підтверджується воля померлої особи та здійснюється управління її майном. Якщо заповіту немає, суд у справах про спадщину здійснює нагляд за розподілом майна відповідно до законів про спадкування за заповітом.

Типи розпоряджень про спадщину в Ізраїлі

В Ізраїлі існує два основних типи розпоряджень про заповіт:

- Наказ про відкриття спадщини за заповітом: Якщо померлий залишив заповіт, виконавець, зазначений у заповіті, подає заяву про визнання заповіту дійсним. Це дає виконавцю повноваження розподіляти активи відповідно до інструкцій у заповіті.

- Порядок правонаступництва: Якщо немає волі, то порядок правонаступництва видається судом у справах про спадщину. Цим розпорядженням призначається адміністратор для нагляду за розподілом майна відповідно до Закону про спадщину.

Роль виконавця

The виконавець відповідає за управління майном, сплату будь-яких боргів і розподіл активів між спадкоємцями. Виконавцем може бути член сім'ї, друг або навіть юрист, залежно від того, кого вибрав померлий. Якщо немає заповіту, суд може призначити адміністратора для виконання цих обов'язків.

Ключова порада: Якщо вас призначено душеприказчиком, важливо розуміти свої обов'язки, які включають сплату боргів і податків перед розподілом майна між спадкоємцями.

4 ключові поради для спадкоємців за кордоном

Якщо ви спадкоємець, який проживає за межами Ізраїлю, управління процесом оформлення спадщини може бути ще більш складним. Ось чотири основні поради, які допоможуть вам легше орієнтуватися в цьому процесі:

1. Найняти ізраїльського юриста, який спеціалізується на спадковому праві

Одним з найважливіших кроків для будь-якого спадкоємця, який проживає за кордоном, є найм адвоката в Ізраїлі, який спеціалізується на спадкове право. Місцевий юрист розбереться в тонкощах ізраїльських процедур оформлення заповіту і може представляти вас в суді, допомагаючи прискорити процес.

- Двомовні послуги: Шукайте адвоката, який пропонує двомовні послуги на івриті та англійській мові. Це полегшить спілкування і забезпечить розуміння всіх аспектів процесу.

2. Отримання необхідної документації

Щоб розпочати процес оформлення заповіту, вам потрібно буде надати кілька документів, серед яких:

- Свідоцтво про смерть: Свідоцтво про смерть з країни, де померла людина, має бути перекладено на іврит і нотаріально завірено.

- Підтвердження права на спадщину: Документи, що підтверджують ваш зв'язок з померлим, наприклад, свідоцтво про народження або свідоцтво про шлюб.

Примітка: Якщо документи складені іноземною мовою, вони повинні бути офіційно перекладені та нотаріально завірені, перш ніж їх можна буде використовувати в ізраїльському суді у справах про спадщину.

3. Розуміти свої податкові зобов'язання

Спадщина в Ізраїлі може включати в себе певні податкові зобов'язання, особливо якщо до складу майна входить нерухомість або інші значні активи. Хоча наразі не існує податок на спадщину в Ізраїлі інші податки, такі як податок на приріст капіталу на нерухомість, можуть застосовуватися. Важливо проконсультуватися з податковим консультантом або адвокатом, щоб зрозуміти, які податки ви можете бути зобов'язані сплатити, і забезпечити дотримання ізраїльського податкового законодавства.

Ключова ідея: Правильне податкове планування може допомогти зменшити податкове навантаження на спадкоємців. Ваш юрист або податковий консультант може надати рекомендації щодо того, як мінімізувати ці зобов'язання.

4. Будьте терплячі до процесу

Процес оформлення заповіту в Ізраїлі може зайняти багато часу, особливо якщо спадщина складна або якщо є суперечки між спадкоємцями. Важливо запастися терпінням і регулярно відвідувати контакт зі своїм адвокатом, щоб отримувати інформацію про стан справи.

- Затримки в оформленні спадщини: Затримки можуть виникнути через неповне оформлення документів, суперечки або складнощі з пошуком усіх спадкоємців. Якщо ви будете організованими і забезпечите своєчасне подання всіх документів, ви можете допомогти прискорити процес.

Підказка: Переконайтеся, що все спілкування з адвокатом добре задокументовано, і що ви зберігаєте копії всіх документів, пов'язаних з процесом спадкування.

Типові проблеми, з якими стикаються спадкоємці у справах про спадщину в Ізраїлі

Спори між спадкоємцями

Спори між спадкоємцями - не рідкість, особливо коли немає заповіту або коли заповіт нечіткий. Ці суперечки можуть затягнути процес оформлення спадщини та призвести до дорогих судових баталій.

- Запобігання виникненню спорів: Найкращий спосіб запобігти суперечкам - це мати чітка та юридично обов'язкова воля. Якщо суперечки все ж виникають, медіація може допомогти вирішити питання без звернення до суду.

Робота з нерухомістю в Ізраїлі

Нерухомість часто становить значну частину спадщини, і робота з нею в Ізраїлі може бути складною, особливо для спадкоємців, які проживають за кордоном. Такі питання, як оцінка майна, податок на приріст капіталу, і передача прав власності може ускладнити процес.

- Призначення представника: Часто рекомендується призначити місцевий представник (наприклад, ваш адвокат), який може управляти майном від вашого імені, включаючи організацію оцінки, продажу або передачі.

Відсутність дійсного заповіту

Якщо померлий не залишив дійсного заповіту, майно буде розподілено відповідно до правила спадкування за заповітом за замовчуванням. Це може не збігатися з бажанням померлого і призвести до суперечок між спадкоємцями. Щоб уникнути цього, дуже важливо заохочувати близьких до створення заповіту, в якому чітко викладені їхні побажання щодо розподілу активів.

Останні думки: Як орієнтуватися в ізраїльському спадковому праві

Спадкове право Ізраїлю може бути складним, особливо для спадкоємців, які проживають за кордоном і не знайомі з місцевою правовою системою. Однак, розуміння основ того, як Спадкове право У цьому розділі ми розповімо про те, що таке спадщина, про важливість наявності дійсного заповіту і про процес оформлення спадщини, щоб зробити цей досвід більш керованим.

Для спадкоємців за кордоном найняти кваліфікованого Ізраїльський юрист який спеціалізується на спадковому праві, дуже важливий. Вони допоможуть вам пройти через процес оформлення заповіту, вирішити будь-які суперечки та забезпечити дотримання всіх законодавчих вимог. З правильною підтримкою ви зможете зорієнтуватися в складнощах успадкування майна в Ізраїлі і переконатися, що спадщина вашої близької людини буде збережена.

Закон Менори тут, щоб надати вам експертну допомогу, необхідну для вирішення питань спадщини в Ізраїлі. Контакти зверніться до нас сьогодні за безкоштовною консультацією, і дозвольте нашій команді досвідчених Ізраїльський юристдопоможуть вам пройти через цей процес.

Детально розібратися в ізраїльському процесі оформлення заповіту

Для багатьох спадкоємців, особливо тих, хто проживає за межами Ізраїлю, орієнтуватися в процесі оформлення заповіту може бути непросто. Нижче ми докладніше розглянемо кожен етап процесу оформлення заповіту в Ізраїлі і те, що вам потрібно знати, щоб пройти його максимально гладко.

Крок 1: Подання заяви про відкриття спадщини

Процес оформлення заповіту починається з подачі заяви запит про заповіт до Реєстратор спадкових справ в Ізраїлі. Цей запит необхідний для визнання заповіту дійсним або, за відсутності заповіту, для визначення законних спадкоємців за ізраїльським законодавством.

Щоб подати запит на заповіт, зазвичай потрібні такі документи:

- Свідоцтво про смерть: Необхідно подати оригінал свідоцтва про смерть, який, можливо, потрібно буде перекласти на іврит і завірити нотаріально.

- Заповіт (якщо застосовується): Якщо є заповіт, його потрібно подати разом із запитом.

- Документи, що посвідчують особу: Необхідно надати документи, що посвідчують особу всіх спадкоємців. Це можуть бути паспорти або посвідчення особи.

- Свідчення під присягою: Може знадобитися свідчення під присягою одного зі спадкоємців або виконавця для підтвердження законності документів, що подаються.

Запит на заповіт також повинен містити детальний опис активів і зобов'язань померлого, якими необхідно управляти.

Крок 2: Публікація публічного повідомлення

Після подачі запиту про відкриття спадщини публічне повідомлення публікується в місцевій газеті, а також в урядовому виданні. Це повідомлення дає змогу всім потенційним спадкоємцям або претендентам заявити про своє право на частку майна, якщо вони вважають, що мають на це право.

Цей крок є обов'язковим для того, щоб усі потенційні спадкоємці мали можливість заявити про свої претензії, тим самим уникнувши майбутніх спорів щодо прав на спадщину. Це особливо важливо, якщо померлий не залишив заповіту і потрібно визначити спадкоємців.

Важливе зауваження: Спадкоємцям слід бути готовими до можливих затримок у цей період, оскільки закон передбачає певний час для відповідей. Це може призвести до збільшення строків оформлення заповіту.

Крок 3: Обробка та слухання

Після цього реєстратор обробляє запит про видачу заповіту. За відсутності заперечень наказ про відкриття спадщини, як правило, видається без необхідності проведення офіційного слухання. Однак, якщо є заперечення, наприклад, спір щодо дійсності заповіту, слухання може бути призначене в Сімейний суд.

Сімейний суд має юрисдикцію у справах про спадщину в Ізраїлі. У разі виникнення спору суд заслуховує аргументи всіх залучених сторін і виносить рішення на основі представлених доказів. Цей етап може зайняти багато часу, особливо якщо спір складний або в ньому беруть участь кілька сторін.

Підказка: Залучення досвідченого Ізраїльський юрист можуть допомогти прискорити процес, оскільки вони краще орієнтуються в законодавчих вимогах і ефективно представляють ваші інтереси на будь-яких слуханнях.

Крок 4: Видача розпорядження про відкриття спадщини

Після того, як Реєстратор або Суд у справах сім'ї переконається, що всі вимоги закону були виконані, він розпорядження про заповіт або порядок правонаступництва видається розпорядження. Це розпорядження надає виконавцю повноваження управляти майном, виплачувати борги та розподіляти активи, що залишилися, відповідно до заповіту або правил спадкування за заповітом.

Розпорядження про відкриття спадщини - це офіційний документ, який надає виконавцю або адміністратору юридичне право виконувати свої обов'язки з управління спадщиною.

Основні проблеми в ізраїльському процесі оформлення спадщини для спадкоємців за кордоном

1. Комплексні вимоги до документації

Однією з найбільших проблем, з якою стикаються спадкоємці за кордоном, є оформлення документів. Ізраїльські суди у справах про спадщину вимагають певну документацію, значна частина якої повинна бути перекладена на іврит і нотаріально завірена. Орієнтуватися в цих вимогах може бути складно, особливо якщо документи походять з іншої країни.

- Переклад та нотаріальне засвідчення: Такі документи, як свідоцтво про народження, свідоцтво про шлюб і свідоцтво про смерть, повинні бути офіційно перекладені і завірені нотаріусом, перш ніж їх можна буде використовувати в ізраїльській процедурі оформлення заповіту.

Підказка: Найміть місцевого юриста, який допоможе вам з цими вимогами і забезпечить належне оформлення всіх документів.

2. Спори між спадкоємцями

Спори між спадкоємцями можуть бути основним джерелом затримок у процесі оформлення заповіту. Такі спори можуть виникати через розбіжності щодо тлумачення заповіту, оцінки майна або навіть через претензії потенційних спадкоємців, які не були згадані в заповіті.

- Посередництво: У багатьох випадках медіація є ефективним способом вирішення спорів, не вдаючись до тривалих і дорогих судових баталій. Медіатор може допомогти полегшити обговорення між спадкоємцями та знайти рішення, яке влаштує всі сторони.

- Юридичне представництво: Юридичне представництво під час вирішення спорів є важливим для захисту ваших прав та інтересів. У випадку, якщо у Вас виникли Ізраїльський юрист Досвідчені юристи, які мають досвід у вирішенні спадкових спорів, допоможуть вам ефективніше орієнтуватися в цьому процесі.

3. Розуміння оцінки активів

Коли ви маєте справу зі спадщиною, всі активи повинні бути належним чином оцінені. Це включає в себе нерухомість, банківські рахунки, особисте майно, і інвестиції. Правильна оцінка має важливе значення для справедливого розподілу активів і для розрахунку будь-яких застосовних податків.

- Оцінка нерухомості: Нерухомість часто є однією з найцінніших складових майна. Нерухомість повинна бути оцінена, щоб визначити її поточну ринкову вартість, яка може вплинути на її розподіл між спадкоємцями. Нерухомість в Ізраїлі значно зросла в ціні за останнє десятиліття, тому точна оцінка має вирішальне значення для забезпечення справедливості.

- Податкові наслідки: Хоча в Ізраїлі немає податку на спадщину, він може бути податок на приріст капіталу щодо продажу успадкованого майна. Важливо проконсультуватися з податковим консультантом, щоб зрозуміти наслідки продажу будь-яких успадкованих вами активів.

4. Передача права власності на нерухомість

Одним із найскладніших аспектів спадкування є передача володіння нерухомістю. Якщо ви успадкували нерухомість в Ізраїлі, вам потрібно буде пройти процес переоформлення права власності на себе. Це включає в себе вирішення питань, пов'язаних з Земельне управління Ізраїлю (ILA) і, можливо, сплачувати податки чи збори.

Процес передачі нерухомості ускладнюється, якщо спадкоємці проживають за кордоном, оскільки документи повинні бути підписані, нотаріально завірені, а іноді й представлені особисто.

Ключова порада: Працюйте з місцевим Ізраїльський юрист які можуть полегшити для вас цей процес і діяти від вашого імені у відносинах з Земельним управлінням Ізраїлю.

Спадкове право Ізраїлю: Права подружжя та дітей

Розуміння прав подружжя за ізраїльським законодавством

Подружжя мають сильні права на спадщину за ізраїльським законодавством. Дружина/чоловік, який/яка пережив/пережила, має право успадкувати всі особисті речі померлого, включаючи такі предмети, як домашні меблі, побутову техніку та автомобілі. Крім того, він успадковує частку майна, що залишилося, в залежності від інших спадкоємців, що залишилися в живих.

- Відносини власності: В рамках Закон про майнові відносини (1973), майно, накопичене під час шлюбу, як правило, вважається спільною власністю. Це означає, що той з подружжя, хто пережив, вже може мати законне право на половину майна подружжя, незалежно від правил спадкування.

- Шлюбні договори: A шлюбний договір може вплинути на спадкові права подружжя. Якщо був укладений шлюбний договір, умови цього договору можуть диктувати порядок поділу майна, що може мати перевагу над правилами спадкування за замовчуванням.

Права дітей та онуків

Діти мають право на рівну частку майна померлого батька. Якщо батьки померли без заповіту, кожна дитина успадковує рівну частку. Якщо дитина померлого випередила їх, то її частка переходить до її власних дітей (тобто онуків).

- Трастові фонди для людей з особливими потребами: У випадках, коли дитина має особливі потреби, може бути доцільно створити трастовий фонд для людей з особливими потребами забезпечити управління спадщиною дитини таким чином, щоб підтримати її довгостроковий догляд та фінансову стабільність. Юрист може допомогти структурувати спадщину так, щоб задовольнити специфічні потреби спадкоємця з інвалідністю.

Важливість складання дійсного заповіту в Ізраїлі

Навіщо складати заповіт?

Хоча ізраїльське законодавство про спадщину за замовчуванням передбачає певні рамки для розподілу активів, маючи дійсний заповіт гарантує, що ваше майно буде розподілене відповідно до ваших побажань. Це особливо важливо, якщо ви хочете залишити певні активи певним спадкоємцям або якщо ви хочете включити осіб, які не входять до традиційної ієрархії спадкування, таких як благодійність або не член сім'ї.

Заповіт також дозволяє це зробити:

- Призначити виконавця: Ви можете призначити особу, якій довіряєте, керувати вашим майном і стежити за виконанням ваших побажань.

- Забезпечення неповнолітніх дітей: Ти можеш назвати опікун для будь-яких неповнолітніх дітей, забезпечуючи догляд за ними відповідно до ваших побажань.

- Уникайте сімейних суперечок: Чітко складений заповіт може допомогти мінімізувати ймовірність суперечок між спадкоємцями, оскільки він містить чіткі інструкції щодо розподілу майна.

Вимоги до дійсного заповіту в Ізраїлі

Щоб бути дійсним за ізраїльським законодавством, заповіт повинен відповідати певним вимогам:

- Письмова форма: Заповіт повинен бути складений у письмовій формі.

- Підпис: Заповіт повинен бути підписаний заповідачем (особою, яка складає заповіт) і засвідчений двома особами, які не є бенефіціарами.

- Свідки: Свідки також повинні підписати заповіт у присутності заповідача.

Усні заповіти також визнаються в Ізраїлі, але лише за певних обставин, наприклад, коли заповідач вважає, що йому загрожує неминуча смерть. Такі заповіти повинні бути складені в присутності двох свідків і подані до суду якнайшвидше.

Типові помилки, яких слід уникати при складанні заповіту

- Не вносити зміни до заповіту: Життєві обставини змінюються, і важливо оновлювати свій заповіт, щоб відобразити ці зміни, наприклад, одруження, розлучення або народження дитини.

- Нечітка мова: Заповіт має бути чітким і конкретним, щоб уникнути плутанини або неправильного тлумачення. Нечіткість заповіту може призвести до суперечок між спадкоємцями.

- Не враховуючи податкові наслідки: Проконсультуйтеся з податковим консультантом, щоб зрозуміти потенційні податкові наслідки вашого заповіту, особливо якщо ви залишаєте нерухомість або інші значні активи.

Роль ізраїльського юриста в управлінні спадщиною

Чому вам потрібен ізраїльський адвокат

Орієнтуватися в спадковому праві в Ізраїлі може бути складно, особливо для іноземних спадкоємців. Наймання адвоката Ізраїльський юрист який спеціалізується на спадковому праві, має вирішальне значення для того, щоб ваші права були захищені, а процес пройшов максимально гладко.

Ан Ізраїльський юрист може допомогти з цим:

- Заяви про відкриття спадщини: Вони можуть допомогти з подачею запиту на заповіт і оформленням всіх необхідних документів.

- Представництво в суді: Якщо виникають суперечки, адвокат може представляти вас у сімейному суді, щоб забезпечити захист ваших інтересів.

- Передача майна: Передача прав власності на нерухомість в Ізраїлі вимагає взаємодії з Земельним управлінням Ізраїлю та дотримання місцевих правил. Юрист може керувати цим процесом від вашого імені.

- Податкове планування: Досвідчений юрист може проконсультувати вас щодо потенційних податкових зобов'язань і допомогти структурувати спадщину таким чином, щоб мінімізувати податки.

Як вибрати правильного ізраїльського адвоката

При виборі Ізраїльський юрист щоб допомогти з питаннями спадщини, врахуйте наступне:

- Досвід: Шукайте юриста з досвідом роботи в ізраїльському спадковому праві, особливо в роботі з міжнародною нерухомістю.

- Комунікація: Обирайте юриста, який може ефективно спілкуватися як на івриті, так і англійською мовою, особливо якщо ви перебуваєте за кордоном.

- Посилання: Попросіть рекомендації від попередніх клієнтів, щоб переконатися, що юрист має хороший послужний список.

Робота з нерухомістю в процесі спадкування

Успадкування нерухомості в Ізраїлі

Нерухомість часто є одним з найцінніших активів у спадщині, і успадкування майна в Ізраїлі може бути значною перевагою. Однак існують певні кроки, які необхідно зробити, щоб передати право власності майна спадкоємцям.

Реєстрація власності в Ізраїльському земельному управлінні (ILA)

The Земельне управління Ізраїлю (УЗІ) відповідає за управління земельною власністю та реєстрацію в Ізраїлі. Щоб передати право власності на успадковану нерухомість, ви повинні:

- Отримання розпорядження про заповіт: Перед тим, як передати майно, вам необхідно отримати у суді наказ про заповіт або наказ про правонаступництво, виданий судом.

- Подати необхідні документи: Сюди входить розпорядження про заповіт, посвідчення особи та інші необхідні документи.

- Сплатіть всі податки та збори, що застосовуються: За передачу майна можуть стягуватися збори, а в разі продажу майна може стягуватися податок на приріст капіталу.

Здача в оренду або продаж успадкованого майна

Після того, як нерухомість буде передана на ваше ім'я, ви можете вирішити оренда або продавати його. Кожен варіант пов'язаний з власним набором юридичних та податкових міркувань:

- Оренда нерухомості: Якщо ви вирішите здавати успадковане майно в оренду, вам потрібно буде дотримуватися місцевих законів про оренду, включаючи обов'язки орендодавця, права орендаря та податкові зобов'язання щодо орендного доходу.

- Продаж нерухомості: Якщо ви вирішили продати нерухомість, ви можете бути зобов'язані податок на приріст капіталу. Сума податку до сплати буде залежати від вартості майна на момент успадкування та його вартості на момент продажу.

Поширені запитання про спадкове право в Ізраїлі

1. Чи може іноземний спадкоємець успадкувати майно в Ізраїлі?

Так, іноземні спадкоємці можуть успадковувати майно в Ізраїлі. Однак процес може бути складнішим через додаткову паперову тяганину, переклади та нотаріальні засвідчення. Бажано найняти Ізраїльський юрист щоб допомогти орієнтуватися в процесі та забезпечити дотримання місцевих законів.

2. Чи потрібно мені перебувати в Ізраїлі, щоб управляти спадщиною?

Ні, вам не обов'язково перебувати в Ізраїлі, щоб керувати процесом спадкування. Ви можете призначити Ізраїльський юрист в якості вашого представника, який займатиметься всіма аспектами процесу оформлення заповіту та передачі майна від вашого імені.

3. Які податки пов'язані зі спадщиною в Ізраїлі?

Хоча наразі не існує податок на спадщину в Ізраїлі можуть застосовуватися інші податки, такі як податок на приріст капіталу якщо ви продаєте успадковане майно. Важливо проконсультуватися з податковим консультантом, щоб зрозуміти свої зобов'язання.

4. Скільки часу триває процес оформлення спадщини?

Тривалість процесу спадкування може варіюватися залежно від складності спадщини та наявності суперечок між спадкоємцями. В середньому це може зайняти від кількох місяців до року. Однак суперечки або відсутність документів можуть спричинити затримки.

5. Що відбувається, якщо немає волі?

Якщо заповіту немає, майно розподіляється за правилами за замовчуванням, викладеними в Ізраїльський закон про спадщину. Черговість спадкування визначається на основі родинних зв'язків, починаючи з чоловіка/дружини та дітей.

6. Як відбувається процес отримання розпорядження про заповіт в Ізраїлі?

Щоб отримати розпорядження про заповіт, вам потрібно подати запит до Реєстратор спадщини. До цього запиту слід додати оригінал заповіту (якщо він існує), свідоцтво про смерть та підтвердження сплати збору за подання заяви. Якщо заповіту немає, вам потрібно буде запросити порядок правонаступництва натомість.

7. Чи можна використовувати іноземний заповіт в Ізраїлі?

Так, заповіт, складений в іншій країні, може бути використаний в Ізраїлі, але він повинен бути підтверджено ізраїльським судом. Зазвичай це передбачає переклад заповіту на іврит і нотаріальне посвідчення, щоб забезпечити його відповідність ізраїльським правовим нормам.

8. Скільки часу триває процес оформлення спадщини?

The процес оформлення заповіту може бути різною за тривалістю, залежно від складності майна та наявності спорів. В середньому це може зайняти від кількох місяців до року. Якщо справа проста, вона може бути вирішена швидше, але суперечки між спадкоємцями або ускладнення зі спадщиною можуть призвести до значних затримок.

9. Чи існує в Ізраїлі податок на спадщину?

Наразі не існує податок на спадщину в Ізраїлі. Однак можуть бути й інші податки, такі як податок на приріст капіталу, якщо до складу спадщини входить майно, яке продається. Бажано проконсультуватися з податковим консультантом, щоб зрозуміти будь-які потенційні податкові зобов'язання.

10. Що робити, якщо спадкоємець відмовляється брати участь у спадковому процесі?

Якщо спадкоємець відмовляється від участі або його місцезнаходження не може бути встановлено, то суд у справах про спадщину може відбуватися без них, залежно від обставин. Суд може призначити опікуна або представника для захисту інтересів відсутнього спадкоємця.

Висновок: Навігація у сфері спадкового права в Ізраїлі

Спадкування майна або активів в Ізраїлі може бути емоційним і складним процесом, особливо для спадкоємців, які проживають за кордоном. Закон про спадщину в Ізраїлі Ізраїльський закон про спадщину забезпечує структуровану основу для розподілу активів, але конкретні процедури, такі як заповіту, передача власності, та працюючи з податки, без належного керівництва може бути складним завданням.

Наймання досвідченого Ізраїльський юрист має вирішальне значення для забезпечення захисту ваших прав і максимально ефективного завершення процесу. Незалежно від того, чи потрібна вам допомога у складанні заповіту, управлінні процесом оформлення спадщини або передачі права власності на нерухомість, належна юридична підтримка може мати вирішальне значення.

Якщо вам потрібна допомога зі спадщиною в Ізраїлі, контакт Закон Менори за безкоштовна консультація. Наша команда досвідчених ізраїльських юристів допоможе вам розібратися в складнощах спадкового права і забезпечити дотримання волі вашої близької людини.

Зв'яжіться з нами: Отримайте допомогу від досвідченого ізраїльського юриста

Якщо ви зіткнулися зі спадковою справою в Ізраїлі, Menora Law готова надати вам необхідну юридичну підтримку. Наша досвідчена команда Ізраїльські юристи допоможе вам пройти через весь процес, від подачі заяви на заповіт до передачі майна.

Як з нами зв'язатися

- whatsApp 24/7 : https://wa.me/message/MDYQGZO5L2Q2D1

- Телефон: +1-323-484-1029

- Веб-сайт: www.menoralaw.com

- Телефон: +1 (323) 484-1029

- Веб-сайт: www.menoralaw.com

Чому варто обирати Закон Менори?

- Експертиза у сфері спадкового права Ізраїлю: Ми спеціалізуємося на всіх аспектах спадкового права, від заповіту до передачі майна.

- Двомовні послуги: Ми пропонуємо юридичні послуги на івриті та англійською мовою, гарантуючи, що міжнародні клієнти розуміють кожен аспект процесу.

- Безкоштовна консультація: Зв'яжіться з нами сьогодні, щоб отримати безкоштовна консультація щоб обговорити ваші потреби у спадкуванні.

Нехай Закон Менори допоможе вам розібратися в складнощах ізраїльського спадкового права і гарантує, що ваші інтереси завжди будуть захищені.