- Understanding Israeli Inheritance Law

- A Quick Overview of Israeli Succession Law

- The Hierarchy of Heirs in Israel

- What Happens If There Is No Will?

- Wills in Israel: Testamentary Succession

- Spouses and Children: Their Rights Under Israeli Succession Law

- Israeli Probate Order: The Legal Procedure for Administering an Estate

- 4 Key Tips for Heirs Abroad

- Common Issues Faced by Heirs in Israeli Inheritance Cases

- Final Thoughts: Navigating Israeli Inheritance Law

- Understanding the Israeli Probate Process in Detail

- Key Challenges in the Israeli Probate Process for Heirs Abroad

- Israeli Inheritance Law: Spouses and Children’s Rights

- Importance of Drafting a Valid Will in Israel

- The Role of an Israeli Lawyer in Managing Inheritance

- Dealing with Real Estate in the Inheritance Process

- Frequently Asked Questions About Inheritance Law in Israel

- 1. Can a Foreign Heir Inherit Property in Israel?

- 2. Do I Need to Be in Israel to Manage the Inheritance?

- 3. What Taxes Are Involved in Inheritance in Israel?

- 4. How Long Does the Inheritance Process Take?

- 5. What Happens If There Is No Will?

- 6. What Is the Process for Obtaining a Probate Order in Israel?

- 7. Can a Foreign Will Be Used in Israel?

- 8. How Long Does the Probate Process Take?

- 9. Is There Inheritance Tax in Israel?

- 10. What If an Heir Refuses to Participate in the Probate Process?

- Conclusion: Navigating the Path of Inheritance Law in Israel

- Contact Us: Get Help from an Experienced Israeli Lawyer

Understanding Israeli Inheritance Law

When a loved one passes away, dealing with the legal procedures surrounding their estate can be a daunting task, especially if the estate is located in Israel and the heirs are based abroad. Israeli inheritance law, while built on principles of fairness and equality, can still present challenges to heirs who are unfamiliar with the specifics of Israeli law or who are living outside the country.

This guide will explain the basics of inheritance law in Israel, focusing on the rules for how property and assets are distributed among heirs, as well as the procedures involved. Additionally, we will provide four essential tips for heirs, particularly those living outside Israel, on how to navigate this process effectively.

A Quick Overview of Israeli Succession Law

Inheritance law in Israel is primarily governed by the Israeli Succession Law of 1965. This law provides the framework for how assets are distributed when a person passes away, regardless of whether or not they left a will. The Israeli inheritance law is designed to ensure a fair division of the estate among the heirs, with an emphasis on equality among family members.

The Principle of Equality

One of the fundamental principles of Israeli inheritance law is equality. This means that, generally speaking, each of a deceased person’s heirs is entitled to an equal share of the estate. The law provides a default hierarchy for inheritance, which determines how an estate will be divided if there is no will in place.

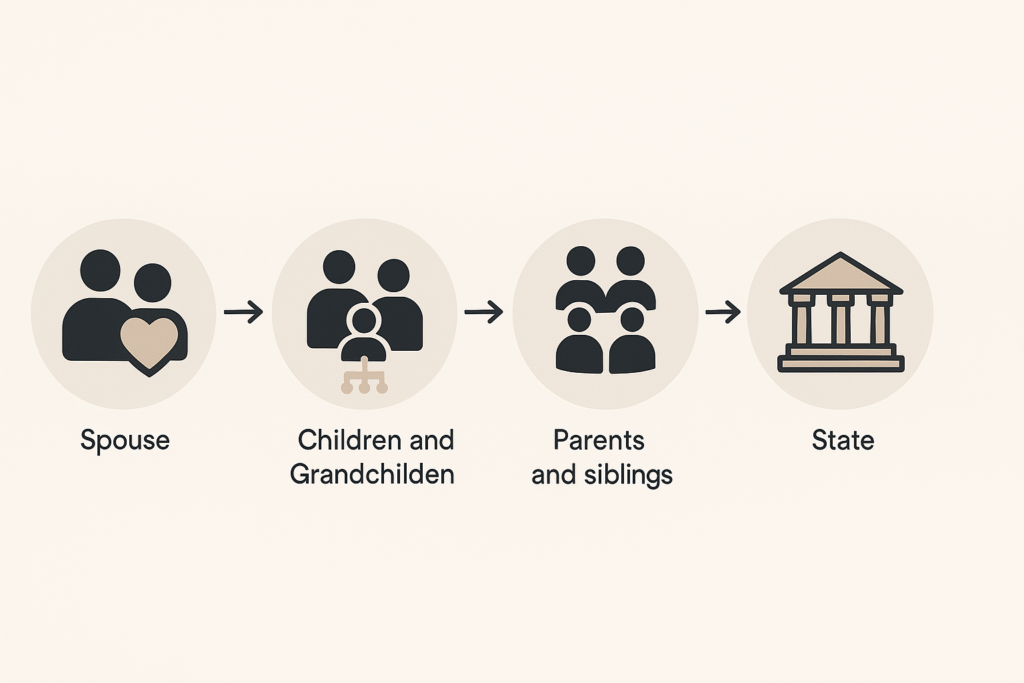

The succession hierarchy in Israel starts with the spouse of the deceased, followed by their children, and then other family members, such as parents and siblings, if there are no children. Understanding this hierarchy is crucial for any heir, as it determines who will receive what portion of the estate.

Changes Over Time

Israeli inheritance law has evolved over time, with changes made to adapt to new social and familial structures. Despite these changes, the underlying principle of equality has remained consistent. It is also important to understand that, even though the law provides a default framework, individuals have the freedom to create wills to distribute their assets in ways that may differ from the default rules set out by the Succession Law.

The Hierarchy of Heirs in Israel

Who Inherits Under Israeli Law?

Under the Israeli Succession Law, there is a clear hierarchy that dictates who is entitled to inherit from a deceased person’s estate:

- The Spouse: The first in line to inherit is the spouse of the deceased. The spouse is entitled to a significant portion of the estate, which may include personal belongings and half of the other assets, depending on whether there are children or other relatives.

- Children and Grandchildren: The next in line are the children of the deceased. The law stipulates that each child should receive an equal share of the estate. If any of the deceased’s children have passed away, their share will be distributed among their descendants (i.e., the grandchildren).

- Parents and Siblings: If the deceased had no children or grandchildren, the parents inherit next, followed by the siblings. If the parents have passed away, the siblings receive the inheritance.

- Extended Family: If there are no direct heirs, the inheritance may pass to more distant relatives, such as grandparents or their descendants (the deceased’s aunts, uncles, and cousins).

- The State: If no heirs are found, the estate will eventually be transferred to the State of Israel.

Example of Inheritance Order

For instance, if an individual passes away leaving behind a spouse, two children, and no will, the estate will be divided between the spouse and the children. The spouse will receive their share, including personal effects like furniture, jewelry, and other belongings, as well as 50% of the remaining assets, while the children will split the remaining 50%.

If the deceased had no spouse but left behind children and grandchildren, the children will inherit the entire estate equally. If a child has passed away before the parent, the deceased child’s share will be inherited by their own children (the deceased’s grandchildren).

What Happens If There Is No Will?

When someone passes away without a will, their estate is said to be intestate. In Israel, intestate succession is governed by default rules set out in the Succession Law. These rules determine who inherits what portion of the estate, based on the hierarchy of heirs.

Intestate Succession Rights in Israel

- Spouse’s Rights: The surviving spouse is entitled to inherit the deceased’s movable property, such as cars, furniture, and personal effects, in addition to half of the remaining assets if there are children.

- Children’s Rights: Children are entitled to an equal share of the remaining estate. If there are no children, the spouse may inherit a larger portion, and if there are no surviving relatives, the entire estate.

- Parents and Siblings: If there is no spouse or children, the deceased’s parents and siblings become the primary heirs. If the parents are not alive, the siblings inherit.

What if There Are No Heirs?

In rare situations where there are no heirs—no spouse, children, grandchildren, parents, or siblings—the estate will be transferred to the State of Israel. The state may decide to use the funds or assets for public benefit.

Wills in Israel: Testamentary Succession

Types of Wills Recognized in Israel

A will is a legal document that allows an individual to determine how their assets will be distributed after their death. In Israel, there are four main types of wills that are recognized by the courts:

- Handwritten Will: The will must be written entirely in the testator’s handwriting and signed by them.

- Witness Will: This is the most common type of will. It must be written and signed in the presence of two witnesses who also sign the document.

- Oral Will: This type of will is made orally in front of two witnesses, typically when the testator believes they are facing imminent death.

- Will Before an Authority: This is a will made in front of an official authority, such as a judge or registrar.

The Importance of Having a Will in Israel

Having a will is essential for those who want their estate to be divided differently from the default rules established by the Succession Law. A will allows individuals to make specific bequests, appoint an executor, and even provide instructions for managing their assets.

For instance, someone may want to leave a larger portion of their estate to a spouse, a specific child, or even to a charitable organization. Without a valid will, the estate will be distributed according to the default inheritance rules, which may not align with the deceased’s wishes.

Spouses and Children: Their Rights Under Israeli Succession Law

Spousal Inheritance Rights

Under Israeli inheritance law, the spouse of the deceased has specific rights. The spouse is entitled to inherit personal belongings, including household items and vehicles. If the deceased leaves behind children, the spouse will also inherit half of the remaining estate, with the other half divided among the children.

- Property Relations Law (1973): According to this law, the property accumulated during the marriage is typically considered joint property, and thus the surviving spouse has a claim to it. This is separate from the inheritance rights, which apply to the remainder of the estate.

Note: The surviving spouse’s rights may be affected if there was a prenuptial agreement or other arrangement in place that alters the default rules.

Children’s Inheritance Rights

Children of the deceased are entitled to an equal share of the estate. This means that if there are multiple children, each child will inherit an equal portion of the estate. Grandchildren may inherit their parent’s share if the parent predeceased the grandparent.

- Intestate Succession Rights: In the absence of a will, children automatically inherit from the deceased parent according to the rules of intestate succession.

Israeli Probate Order: The Legal Procedure for Administering an Estate

What Is Probate?

Probate is the legal process by which a deceased person’s will is validated, and their estate is administered. If there is no will, the probate court oversees the distribution of the estate according to the laws of intestate succession.

Types of Probate Orders in Israel

There are two main types of probate orders in Israel:

- Probate Order for a Will: If the deceased left a will, the executor named in the will applies for a probate order to validate the will. This gives the executor the authority to distribute the assets according to the instructions in the will.

- Order of Succession: If there is no will, an order of succession is issued by the probate court. This order appoints an administrator to oversee the distribution of the estate according to the Succession Law.

The Role of the Executor

The executor is responsible for managing the estate, paying any outstanding debts, and distributing the assets to the heirs. The executor can be a family member, a friend, or even a lawyer, depending on who the deceased chose. If there is no will, the court may appoint an administrator to perform these duties.

Key Tip: If you are named as an executor, it’s important to understand your responsibilities, which include paying debts and taxes before distributing the estate to the heirs.

4 Key Tips for Heirs Abroad

If you are an heir living outside Israel, managing the inheritance process can be even more challenging. Here are four essential tips to help you navigate the process more easily:

1. Hire an Israeli Lawyer Specializing in Inheritance Law

One of the most important steps for any heir living abroad is to hire a lawyer in Israel who specializes in inheritance law. A local lawyer will understand the intricacies of Israeli probate procedures and can represent you in court, helping to speed up the process.

- Bilingual Services: Look for a lawyer who offers bilingual services in Hebrew and English. This will make communication easier and ensure you understand all aspects of the process.

2. Obtain the Necessary Documentation

To initiate the probate process, you will need to provide several documents, including:

- Death Certificate: A death certificate from the country where the individual passed away must be translated into Hebrew and notarized.

- Proof of Heirship: Documentation proving your relationship to the deceased, such as a birth certificate or marriage certificate.

Note: If the documents are in a foreign language, they must be officially translated and notarized before they can be used in Israeli probate court.

3. Understand Your Tax Obligations

Inheritance in Israel may involve certain tax obligations, especially if the estate includes real estate or other significant assets. While there is currently no inheritance tax in Israel, other taxes, such as capital gains tax on real estate, may apply. It’s important to consult with a tax advisor or your lawyer to understand what taxes may be owed and to ensure compliance with Israeli tax laws.

Key Insight: Proper tax planning can help reduce the tax burden on the heirs. Your lawyer or tax advisor can provide guidance on how to minimize these obligations.

4. Be Patient with the Process

The probate process in Israel can take time, especially if the estate is complex or if there are disputes among heirs. It’s important to be patient and stay in regular contact with your lawyer to receive updates on the status of the case.

- Delays in Probate: Delays may occur due to incomplete paperwork, disputes, or complications in locating all heirs. By staying organized and ensuring that all documents are submitted promptly, you can help speed up the process.

Tip: Make sure all communication with your lawyer is well-documented and that you keep copies of all paperwork related to the inheritance process.

Common Issues Faced by Heirs in Israeli Inheritance Cases

Disputes Among Heirs

Disputes among heirs are not uncommon, especially when there is no will or when the will is unclear. These disputes can delay the probate process and lead to costly legal battles.

- Preventing Disputes: The best way to prevent disputes is to have a clear and legally binding will. If disputes do arise, mediation may be an option to help resolve issues without going to court.

Dealing with Real Estate in Israel

Real estate often forms a significant part of an estate, and dealing with property in Israel can be challenging, especially for heirs living abroad. Issues such as property valuation, capital gains tax, and title transfers can complicate the process.

- Appointing a Representative: It is often advisable to appoint a local representative (such as your lawyer) who can manage the property on your behalf, including arranging for valuation, sale, or transfer.

Lack of a Valid Will

If the deceased did not leave a valid will, the estate will be distributed according to the default rules of intestate succession. This may not align with the deceased’s wishes and can lead to disputes among heirs. To avoid this, it’s crucial to encourage loved ones to create a will that clearly outlines their wishes for the distribution of their assets.

Final Thoughts: Navigating Israeli Inheritance Law

Israeli inheritance law can be complex, especially for heirs living abroad who are unfamiliar with the local legal system. However, understanding the basics of how the Succession Law works, the importance of having a valid will, and the probate process can help make the experience more manageable.

For heirs abroad, hiring a qualified Israeli lawyer who specializes in inheritance law is essential. They can help guide you through the probate process, handle any disputes, and ensure that all legal requirements are met. With the right support, you can navigate the complexities of inheriting property in Israel and ensure that your loved one’s legacy is preserved.

Menora Law is here to provide the expertise you need when dealing with inheritance matters in Israel. Contact us today for a free consultation, and let our team of experienced Israeli lawyers help guide you through the process.

Understanding the Israeli Probate Process in Detail

For many heirs, particularly those based outside Israel, navigating the probate process can be overwhelming. Here’s a closer look at each step of the probate process in Israel and what you need to know to make it through as smoothly as possible.

Step 1: Submitting the Probate Request

The probate process begins with submitting a probate request to the Registrar of Inheritance Affairs in Israel. This request is necessary to either validate a will or, in the absence of a will, to determine the rightful heirs under Israeli law.

To submit a probate request, the following documents are usually required:

- Death Certificate: The original death certificate must be submitted, which may need to be translated into Hebrew and notarized.

- Will (If Applicable): If there is a will, it must be submitted along with the request.

- Identification Documents: Proof of identity for all heirs must be provided. This could include passports or identity cards.

- Affidavit: An affidavit may be needed from one of the heirs or the executor to verify the legitimacy of the documents being submitted.

The probate request should also include a detailed account of the deceased’s assets and any liabilities that need to be managed.

Step 2: Publishing a Public Notice

After the probate request is filed, a public notice is published in a local newspaper, as well as in a government publication. This notice allows any potential heirs or claimants to come forward if they believe they have a right to a share of the estate.

This step is mandatory to ensure that all potential heirs are given an opportunity to assert their claims, thereby avoiding future disputes over inheritance rights. It is particularly important if the deceased did not leave a will and heirs need to be identified.

Important Note: Heirs should be prepared for potential delays during this period, as the law mandates a specific amount of time for responses. This can lead to longer probate timelines.

Step 3: Processing and Hearing

The Registrar will then process the probate request. If there are no objections, the probate order is typically issued without the need for a formal hearing. However, if objections are raised, such as a dispute over the validity of the will, a hearing may be scheduled in the Family Court.

The Family Court has jurisdiction over inheritance matters in Israel. If there is a dispute, the court will hear arguments from all parties involved and make a determination based on the evidence presented. This stage can be time-consuming, especially if disputes are complicated or involve multiple parties.

Tip: Engaging an experienced Israeli lawyer can help speed up the process, as they can navigate the legal requirements more efficiently and effectively represent your interests in any hearings.

Step 4: Issuing the Probate Order

Once the Registrar or the Family Court is satisfied that all legal requirements have been met, a probate order or order of succession is issued. This order gives the executor the authority to manage the estate, pay off any debts, and distribute the remaining assets according to the will or the rules of intestate succession.

The probate order is the official document that grants the executor or administrator the legal right to carry out their duties in managing the estate.

Key Challenges in the Israeli Probate Process for Heirs Abroad

1. Complex Documentation Requirements

One of the biggest challenges faced by heirs abroad is managing the paperwork. Israeli probate courts require specific documentation, much of which must be translated into Hebrew and notarized. Navigating these requirements can be cumbersome, especially if the documents originate from another country.

- Translation and Notarization: Documents like birth certificates, marriage certificates, and death certificates must be officially translated and notarized before they can be used in Israeli probate proceedings.

Tip: Hire a local lawyer who can assist you with these requirements and ensure that all paperwork is handled properly.

2. Disputes Among Heirs

Disputes among heirs can be a major source of delay in the probate process. Such disputes may arise due to disagreements about the interpretation of a will, the valuation of assets, or even claims from potential heirs who were not mentioned in the will.

- Mediation: In many cases, mediation is an effective way to resolve disputes without resorting to lengthy and expensive court battles. A mediator can help facilitate discussions between heirs and find a resolution that is agreeable to all parties.

- Legal Representation: Having legal representation during disputes is essential to protect your rights and interests. An Israeli lawyer experienced in inheritance disputes can help you navigate this process more effectively.

3. Understanding the Valuation of Assets

When dealing with an estate, all assets must be properly valued. This includes real estate, bank accounts, personal property, and investments. Proper valuation is essential for the fair distribution of assets and for calculating any applicable taxes.

- Real Estate Valuation: Real estate is often one of the most valuable components of an estate. Property must be appraised to determine its current market value, which can impact how it is distributed among heirs. Real estate in Israel has seen significant appreciation in value over the past decade, so accurate valuation is crucial to ensure fairness.

- Tax Implications: While there is no inheritance tax in Israel, there may be capital gains tax on the sale of inherited property. It is important to consult with a tax advisor to understand the implications of selling any assets you inherit.

4. Transferring Ownership of Real Estate

One of the most complex aspects of inheritance is the transfer of real estate ownership. If you inherit real estate in Israel, you will need to go through the process of transferring the property title into your name. This involves dealing with the Israel Land Authority (ILA) and possibly paying taxes or fees.

The process of transferring real estate is made more challenging when heirs are living abroad, as documents must be signed, notarized, and sometimes presented in person.

Key Tip: Work with a local Israeli lawyer who can facilitate this process for you and act on your behalf in dealing with the Israel Land Authority.

Israeli Inheritance Law: Spouses and Children’s Rights

Understanding Spousal Rights Under Israeli Law

Spouses have strong inheritance rights under Israeli law. The surviving spouse is entitled to inherit all personal belongings of the deceased, including items like household furniture, appliances, and cars. Additionally, the spouse will inherit a share of the remainder of the estate, depending on the other surviving heirs.

- Property Relations: Under the Property Relations Law (1973), property accumulated during the marriage is generally considered joint property. This means the surviving spouse may already have a legal right to half of the marital property, regardless of the inheritance rules.

- Prenuptial Agreements: A prenuptial agreement can impact spousal inheritance rights. If there was a prenuptial agreement in place, the terms of that agreement may dictate how the property is divided, which could override the default rules of inheritance.

Rights of Children and Grandchildren

Children are entitled to an equal share of the deceased parent’s estate. If the parent passes away without a will, each child will inherit an equal portion. If a child of the deceased has predeceased them, that child’s share will pass to their own children (i.e., the grandchildren).

- Special Needs Trusts: In cases where a child has special needs, it may be advisable to set up a special needs trust to ensure the child’s inheritance is managed in a way that supports their long-term care and financial stability. A lawyer can help structure the inheritance to meet the specific needs of a disabled heir.

Importance of Drafting a Valid Will in Israel

Why Should You Draft a Will?

While Israeli inheritance law provides a default framework for asset distribution, having a valid will in place ensures that your estate is distributed according to your wishes. This is especially important if you wish to leave specific assets to certain heirs or if you want to include individuals outside the traditional inheritance hierarchy, such as a charity or a non-family member.

A will also allows you to:

- Appoint an Executor: You can appoint someone you trust to manage your estate and ensure your wishes are carried out.

- Provide for Minor Children: You can name a guardian for any minor children, ensuring they are cared for according to your wishes.

- Avoid Family Disputes: A clearly written will can help minimize the likelihood of disputes among heirs, as it provides clear instructions for how the estate should be divided.

Requirements for a Valid Will in Israel

To be valid under Israeli law, a will must meet certain requirements:

- Written Form: The will must be in writing.

- Signature: The will must be signed by the testator (the person making the will) and witnessed by two individuals who are not beneficiaries.

- Witnesses: The witnesses must also sign the will in the presence of the testator.

Oral Wills are also recognized in Israel, but only in specific circumstances, such as when the testator believes they are facing imminent death. These wills must be made in the presence of two witnesses and submitted to the court as soon as possible.

Common Mistakes to Avoid When Drafting a Will

- Not Updating the Will: Life circumstances change, and it is important to update your will to reflect these changes, such as marriage, divorce, or the birth of a child.

- Vague Language: The will should be clear and specific to avoid confusion or misinterpretation. Ambiguity in a will can lead to disputes among heirs.

- Not Considering Tax Implications: Consult with a tax advisor to understand the potential tax implications of your bequests, especially if you are leaving real estate or other significant assets.

The Role of an Israeli Lawyer in Managing Inheritance

Why You Need an Israeli Lawyer

Navigating inheritance law in Israel can be complex, especially for foreign heirs. Hiring an Israeli lawyer who specializes in inheritance law is crucial for ensuring that your rights are protected and that the process goes as smoothly as possible.

An Israeli lawyer can help with:

- Probate Applications: They can assist with filing the probate request and managing all necessary paperwork.

- Representation in Court: If disputes arise, a lawyer can represent you in Family Court to ensure your interests are protected.

- Property Transfers: Transferring real estate titles in Israel requires dealing with the Israel Land Authority and ensuring compliance with local regulations. A lawyer can manage this process on your behalf.

- Tax Planning: An experienced lawyer can advise you on potential tax liabilities and help structure the inheritance in a way that minimizes taxes.

How to Choose the Right Israeli Lawyer

When choosing an Israeli lawyer to help with inheritance matters, consider the following:

- Experience: Look for a lawyer with experience in Israeli inheritance law, particularly in handling international estates.

- Communication: Choose a lawyer who can communicate effectively in both Hebrew and English, especially if you are based abroad.

- References: Ask for references from previous clients to ensure the lawyer has a good track record.

Dealing with Real Estate in the Inheritance Process

Inheriting Real Estate in Israel

Real estate is often one of the most valuable assets in an estate, and inheriting property in Israel can be a significant benefit. However, there are specific steps that must be taken to transfer ownership of the property to the heirs.

Property Registration with the Israel Land Authority (ILA)

The Israel Land Authority (ILA) is responsible for managing land ownership and registration in Israel. To transfer ownership of inherited real estate, you must:

- Obtain a Probate Order: Before transferring property, you need to have the probate order or succession order issued by the court.

- Submit the Necessary Documents: This includes the probate order, proof of identity, and any other required paperwork.

- Pay Any Applicable Taxes and Fees: There may be fees associated with transferring property, and capital gains tax may apply if the property is sold.

Renting or Selling Inherited Property

Once the property is transferred into your name, you may decide to rent or sell it. Each option comes with its own set of legal and tax considerations:

- Renting the Property: If you choose to rent out the inherited property, you will need to comply with local rental laws, including landlord obligations, tenant rights, and tax obligations on rental income.

- Selling the Property: If you decide to sell the property, you may be subject to capital gains tax. The amount of tax owed will depend on the property’s value at the time of inheritance and its value at the time of sale.

Frequently Asked Questions About Inheritance Law in Israel

1. Can a Foreign Heir Inherit Property in Israel?

Yes, foreign heirs can inherit property in Israel. However, the process may be more complicated due to additional paperwork, translations, and notarizations. It is advisable to hire an Israeli lawyer to help navigate the process and ensure compliance with local laws.

2. Do I Need to Be in Israel to Manage the Inheritance?

No, you do not need to be in Israel to manage the inheritance process. You can appoint an Israeli lawyer as your representative to handle all aspects of the probate and property transfer process on your behalf.

3. What Taxes Are Involved in Inheritance in Israel?

While there is currently no inheritance tax in Israel, other taxes may apply, such as capital gains tax if you sell an inherited property. It is important to consult with a tax advisor to understand your obligations.

4. How Long Does the Inheritance Process Take?

The length of the inheritance process can vary depending on the complexity of the estate and whether there are disputes among heirs. On average, it can take between several months to a year. However, disputes or missing documentation can cause delays.

5. What Happens If There Is No Will?

If there is no will, the estate is distributed according to the default rules set out in the Israeli Succession Law. The order of inheritance is determined based on familial relationships, starting with the spouse and children.

6. What Is the Process for Obtaining a Probate Order in Israel?

To obtain a probate order, you will need to file a request with the Registrar of Inheritance. This request should include the original will (if one exists), a death certificate, and proof of payment for the application fee. If there is no will, you will need to request an order of succession instead.

7. Can a Foreign Will Be Used in Israel?

Yes, a will made in another country can be used in Israel, but it must be validated by an Israeli court. This usually involves translating the will into Hebrew and providing notarization to ensure it meets Israeli legal standards.

8. How Long Does the Probate Process Take?

The probate process can vary in length, depending on the complexity of the estate and whether there are disputes. On average, it may take anywhere from several months to a year. If the case is straightforward, it may be resolved more quickly, but disputes among heirs or complications with the estate can lead to significant delays.

9. Is There Inheritance Tax in Israel?

Currently, there is no inheritance tax in Israel. However, there may be other taxes, such as capital gains tax, if the estate includes property that is being sold. It is advisable to consult a tax advisor to understand any potential tax liabilities.

10. What If an Heir Refuses to Participate in the Probate Process?

If an heir refuses to participate or cannot be located, the probate court may proceed without them, depending on the circumstances. The court may appoint a guardian or representative to protect the interests of the missing heir.

Conclusion: Navigating the Path of Inheritance Law in Israel

Inheriting property or assets in Israel can be both an emotional and complex process, especially for heirs living abroad. The Israeli Succession Law provides a structured framework for distributing assets, but the specific procedures involved, such as probate, property transfers, and dealing with taxes, can be challenging without proper guidance.

Hiring an experienced Israeli lawyer is crucial for ensuring that your rights are protected and that the process is completed as efficiently as possible. Whether you need help drafting a will, managing the probate process, or transferring ownership of real estate, having the right legal support can make all the difference.

If you need assistance with an inheritance matter in Israel, contact Menora Law for a free consultation. Our team of experienced Israeli lawyers is here to help you navigate the complexities of inheritance law and ensure that your loved one’s wishes are respected.

Contact Us: Get Help from an Experienced Israeli Lawyer

If you are facing an inheritance matter in Israel, Menora Law is here to provide the legal support you need. Our experienced team of Israeli lawyers can help guide you through the entire process, from probate applications to property transfers.

How to Contact Us

- whatsApp 24/7 : https://wa.me/message/MDYQGZO5L2Q2D1

- Phone: +1-323-484-1029

- Website: www.menoralaw.com

- Phone: +1 (323) 484-1029

- Website: www.menoralaw.com

Why Choose Menora Law?

- Expertise in Israeli Inheritance Law: We specialize in all aspects of inheritance law, from probate to property transfers.

- Bilingual Services: We offer legal services in both Hebrew and English, ensuring that international clients understand every aspect of the process.

- Free Consultation: Contact us today for a free consultation to discuss your inheritance needs.

Let Menora Law guide you through the complexities of Israeli inheritance law and ensure that your interests are always protected.